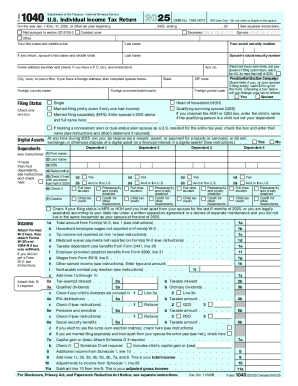

IRS 1040 2015 free printable template

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

About IRS previous version

What is IRS 1040?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

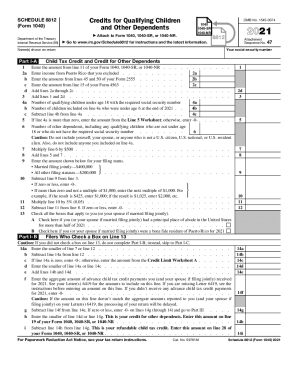

Is the form accompanied by other forms?

FAQ about IRS 1040

What should I do if I made a mistake on my forms 1040 2015?

If you've made an error on your forms 1040 2015, you can submit an amended return using Form 1040-X. It’s important to ensure that the corrections are clearly documented and to provide any necessary explanations. Additionally, keep an eye on the status of your amendment to verify that it has been processed.

How can I track the status of my forms 1040 2015 after filing?

You can track the status of your forms 1040 2015 by using the IRS 'Where's My Refund?' tool, available on the IRS website. Make sure to have your personal details ready, such as your Social Security number, filing status, and the exact amount of your refund. This tool provides updates on the processing of your return.

What should I do if I receive a notice regarding my forms 1040 2015?

If you receive a notice related to your forms 1040 2015, read it carefully to understand the issue. Gather any required documentation and respond to the notice promptly, ensuring to follow the instructions provided. Keeping detailed records of your correspondence can also help in tracking any potential audits.

What are the common errors I should avoid when filing forms 1040 2015?

Common errors when filing forms 1040 2015 include incorrect Social Security numbers, failing to sign the form, and misreporting income. Carefully review your tax documents and double-check figures to ensure accuracy before submission. Utilizing tax software can also help in minimizing these mistakes.

How do I ensure my forms 1040 2015 are secure when e-filing?

To ensure the security of your forms 1040 2015 when e-filing, use reputable tax software that offers encryption and secure transmission of your data. Be cautious about accessing your information over public Wi-Fi and regularly updating your passwords for security. Keeping your software updated also enhances your protection.

See what our users say